Jake Bernstein's Blog

February 26, 2018

Crossroads for Kushner

At the beginning of the Trump administration, Jared Kushner, the president’s son-in-law, was given a portfolio Superman would have struggled to fill. Kushner wasn’t even Clark Kent. The 36-year-old second generation real estate tycoon had an undistinguished business career and zero government experience. A mediocre student, Kushner attended Harvard because his father gifted the school $2.5 million. Nonetheless, Trump put Kushner in charge of brokering peace between Israel and the Palestinians, improving government technology, directing criminal justice reform, tackling the opioid epidemic, reforming the Veterans Administration and serving as the U.S. liaison to Mexico, China and the Muslim community.

Either Donald Trump thought his son-in-law was a genius or was ridiculing his ambition. If the metric was tangible progress on these world-altering tasks, Trump clearly set up the young man to fail.

Or perhaps, Donald Trump had another purpose for Kushner, apart from his official responsibilities.

In the game of musical chairs that has become his father-in-law’s administration, did Trump tap Kushner to be the last man standing when the music stops? Trump’s motivations concerning Kushner will take on greater importance in the months to come, when hard choices may become inevitable.

In the early days of the administration, Kushner was everywhere. He was in attendance at most important White House meetings. His youthful face easy to spot in official photos. Press accounts of the internecine struggles gripping the White House inevitably included a description of whose side Kushner and wife Ivanka favored.

Then came the firing of FBI Director James Comey, which inexorably led to the appointment of the special prosecutor. Kushner allegedly counseled the president to sack Comey. Today, Kushner mostly stays out of view. He is no longer the man by the president’s side, at least in public. However, disentangling oneself from press releases does not guarantee an escape from news accounts.

Recent reports have claimed the IRS, the DOJ and Special Counsel Robert Mueller are all looking at either Kushner or business dealings in which he or his family participated. His lawyers deny he is the target of any investigation.

Unfortunately for Kushner, he is tailor-made for prosecutors, presenting a trifecta of criminal tells. Kushner possesses both the means and the motive for breaking the law. He is also curiously cagey. When it comes to his financial activities, Kushner acts as if he has a lot to hide.

On the question of means, there are few in closer proximity to power. As to motive, aside from the eager ambition of an entitled naïf and the desire for his father-in-law to win the presidency, Kushner’s privately held family company is drowning in more than a billion dollars of debt.

And oh, the stories Kushner could tell.

He has first-hand information about the Trump campaign’s contacts with Russians but that’s only the beginning of what he knows. His connections to Bibi Netanyahu and Saudi Crown Prince Mohammed bin Salman have created further opportunities for private financial gain and fodder to share about Trump.

Kushner was intimately involved at every step of the campaign. He was present at the infamous June 2016 meeting where Donald Trump Jr. and Paul Manafort met with several Kremlin-connected Russians to receive dirt on the Clinton campaign. After the election, he continued to see Russians officials, even though they represented a foreign adversary widely acknowledged to have committed a cyberattack against the nation, albeit one on Trump’s behalf.

In December, Kushner met with Russia’s ambassador, Sergey Kislyak, at Trump Tower where he discussed establishing an unprecedented secure line between the Trump transition and Russia that would be out of earshot of U.S. intelligence officials. Seasoned intelligence professionals were aghast. On whose behalf did Kushner act? For what purpose? And once the Trumps were in the White House, did they go ahead and install a server or create a backchannel communication to Putin anyway?

Then Kislyak arranged a meeting for Kushner with Sergey Gorkov, the CEO of Russia’s state-owned bank Vnesheconombank (VEB). The bank had served as a slush fund for Vladimir Putin and was under sanction by the U.S. government. Descriptions of the meeting conflict. Kushner says he was there as part of the Trump transition. VEB says it was about the Kushner family’s real estate business. One could conclude the Russians do not have Kushner’s back.

Kushner’s family business is in a bad state. His father, Charles Kushner, was released from federal custody in August 2006. He had served a 14-month stint on a two-year sentence for tax evasion, witness tampering and illegal campaign donations. Charlie returned with a vengeance. The family purchased 666 Fifth Avenue for $1.8 billion soon after his release. The building has become an albatross, never reaching satisfactory occupancy levels.

The unfortunately numbered Fifth Avenue property was only the beginning of the buying spree. The Kushners purchased two massive properties within spitting distance of the Brooklyn Bridge for almost $700 million. In the years before the election, the Kushners added well over 100 additional properties. To fuel the expansion, Kushner and his family gorged on debt. The origins of some of their financing remains hidden through the secrecy world, a haze of shell companies, tax havens and anonymous foreign investors.

By the time Trump improbably won the White House, the Kushners were in desperate need of new investors. They were massively overleveraged. On the 666 Fifth Avenue property alone they owed a $1.2 billion mortgage scheduled to come due in February 2019.

Kushner co-mingled his search for real estate financing with his official government duties. Reporters and prosecutors noticed. The practice of embracing private self-interest while ostensibly working for the public was normalized at the top but Kushner was clumsier than his father-in-law.

During the transition, Kushner pursued Chinese insurance giant Anbang – itself an opaquely-financed real estate investor but one with ties to the Chinese government – to buy 666 Fifth Avenue. Kushner did so while simultaneously spearheading the Trump administration’s outreach to China. Anbang backed away from the 666 Fifth Avenue deal over the conflicts. A year later the Chinese government seized control of the company citing financial improprieties.

The Kushners also hatched a scheme to sell foreigners green cards in exchange for investing at least half a million dollars in their real estate deals. Prosecutors and the SEC are said to be scrutinizing these efforts.

A month before Election Day, the Kushner company scored a $285 million loan as part of a refinancing for its property near Times Square in Manhattan. The loan came from Deutsche Bank. The German bank has provided a rich vein of money for Trump World. U.S. prosecutors are said to be looking at the bank’s relationship with the Kushners.

In Germany, they joke that any gathering of more than two Deutsche Bank executives is a criminal conspiracy. The bank was recently fined $630 million for laundering billions of dollars of sketchy Russian money. It reached a $7.2 billion settlement with the Justice Department for its role in feeding the toxic mortgage frenzy behind the 2008 financial crisis. Deutsche also agreed to pay $2.5 billion for its manipulation of interest rates. Given its frequent clashes with regulators, the relationship between Deutsche Bank and Trump & Co. raises multiple issues.

Kushner has exhibited a curious pattern of secrecy and misleading disclosures. The tone once again was set at the top with Trump’s refusal to release his tax returns. Kushner though does not have the same authority or mandate as his father-in-law in this regard. He is required by law as a government employee to disclose his finances, among other details.

The financing behind the Kushner real estate empire remains opaque. The family is fighting hard for it to stay secret. Media organizations sued in federal court to find out the details of who invested in a Kushner property in Maryland. When a federal district judge ruled that the Kushners had to reveal the information, the to state court.

After pillorying Hillary Clinton during the campaign for having a private email server, it emerged that Kushner and Ivanka had conducted official Trump administration business through private email. Much has been made in the media of the hypocrisy but less so over what they may or may not be hiding.

Kushner and Ivanka have updated their financial disclosure forms dozens of times since first filing them. Even with their additions, the forms are still missing key information. Kushner is also required to reveal his contacts with foreign officials. He filed three updates just last year to the questionnaire that details contacts with foreign officials. These contacts also have become a point of interest for Mueller, according to media reports.

Kushner has only held an interim security clearance since Trump took office. It appears the DOJ has argued against his receiving full clearance. High-level access to the most sensitive secrets of the United States government and the ability to influence policy can be monetized in any number of ways. Despite not having full clearance, The Washington Post reported Kushner makes more requests for information to the intelligence community than any White House employee outside of the national security council.

Kushner is fiercely resisting any attempt to downgrade his access. According to press accounts, there is a heated debate within the White House over whether Kushner will be granted full security clearance. The DOJ’s reticence may be an indication of the seriousness of the investigations swirling around Kushner and whether his family business can withstand a determined deep dive by prosecutors.

His father-in-law could end the debate this minute. Trump has the power to grant a full security clearance to Kushner immediately. Instead, he has chosen to leave the decision to his chief of staff while praising his son-in-law as “truly outstanding” and “an extraordinary dealmaker.”

Why won’t Trump let Kushner off the hook? Does he see trouble ahead? Was this the praise of death?

Kushner allegedly stepped down from the family business when he joined the administration, opting for a transfer of assets to relatives, the same pseudo divestment as Trump. It is possible that Jared Kushner is everything his lawyers and public relations team claim him to be – innocent as the driven snow – a simple public servant who labors hard on behalf of the people at incredible personal sacrifice.

Given time and resources, Mueller will find out one way or another.

With the plea deal of Rick Gates, the special prosecutor is one step closer. Kushner and Gates worked closely together during the campaign and transition. Gates might be able to shed light on Kushner activities concerning Cambridge Analytica as well as contacts with Russia, among other matters.

The special prosecutor has shown a willingness to grant immunity or strike plea deals in exchange for testimony. To gain such a deal one presumably needs to be able to offer high value to the investigation. There is only one person above Jared Kushner that would provide the most benefit to prosecutors.

In a scenario where the special counsel finds serious criminal wrongdoing by Kushner, the president’s son-in-law would need to be completely truthful, offering “full cooperation,” as the condition of any plea agreement. Mueller has some incredibly talented prosecutors and investigators at his disposal. They know the right questions to ask. Lies and misrepresentations end the deal and bring additional penalties.

Some part of Donald Trump must believe that the American people gave him the keys to the Big Rock Candy Mountain, a conman’s paradise where one lives entirely above the law. His buddies Vladimir Putin and Mohammed bin Salman happily reside there. Why not The Donald?

Kushner could disabuse Trump of that notion, salvage the American ideal of equality before the law, and become a hero to a majority of the country in the process. Or he could take whatever hit prosecutors throw at him and remain within the bosom of the family into which he married – sweetened perhaps with the promise of some future favor.

There are many factors Kushner must calculate in such a decision. Trump has repeatedly shown himself to be an untrustworthy ally. Kushner is not blood; he is expendable. Forced to choose, Ivanka would go with her father.

Kushner is the perfect fall guy, foolishly ambitious and overextended, entangled enough to ensure loyalty and prosecutor catnip.

In the above scenario, everything will depend on the size of the legal jeopardy Kushner faces and whether there is a Superman in there after all.

The post Crossroads for Kushner appeared first on Jake Bernstein.

Related posts:

Happy New Year

Trump Ocean Club Buyers

Panama Papers Update

January 30, 2018

New Financial Secrecy Index

There is much to pick over in the new Financial Secrecy rankings released today by the Tax Justice Network. The last time TJN released its index was in 2015.

TJN’s index seeks to rank places by their secrecy and the scale of their offshore financial activities. It offers a way to both highlight who the worst offenders are in the secrecy world and track those who have improved. The goal is to provide insight into global financial secrecy, illicit financial flows, tax evasion, capital flight and the operation of tax havens.

Since the index’s first appearance in 2009, it has demonstrated that tax havens are not necessarily places with palm trees and tropical breezes.

Once again, the United States is at or near the top of the rankings, number two, in this case. TJN combines both a secrecy score and a weighting based on impact to arrive at its score. The USA is not the most secretive jurisdiction; Vanuatu has that dishonor. While the secrecy number for the US is a significant 59%, its global weighting of 22% is what vaults it to dominance in the rankings.

In the secrecy world – the offshore system through which TJN estimates $21 to $32 trillion flow – the United States and the United Kingdom are the biggest players. These giants set the rules, often by doing nothing. Any abuses that occur happen in part because these dominant players tolerate them.

If the United States is the number two secrecy jurisdiction in the world, Delaware is a big reason why. Delaware is literally the template for incorporation laws from Panama to the British Virgin Islands. The tiny state produced more than 128,000 LLCs in 2015.

Delaware’s public registry pulls in more than a billion dollars a year. Not surprisingly, Delaware has been at the forefront of beating back federal efforts to make the US more transparent.

An estimated $300 billion is laundered through the United States annually. Delaware and states like Nevada and Wyoming play a big role. The U.S. Treasury Department has complained that Eurasian organized crime figures, among other criminals, employ Delaware companies.

According to TJN, the United States was one of the only places to see its secrecy increase in 2015 and the trend continues.

Jürgen Mossack, the founder of the firm whose data formed the Panama Papers, asserted that the biggest beneficiary of the leak investigation into Mossack Fonseca was the United States. He anticipated that the Americans would take advantage of the decline of Panama and the British Virgin Islands to grab a bigger slice of the business.

TJN notes:

Between 2015 and 2018 the US increased its market share in offshore financial services by 14%. In total the US accounts for 22.3% of the global market in offshore financial services.

Number one in TJN’s ranking is Switzerland. The alpine nation still offers the gold standard of secrecy with a score of 76%. In Europe, only Liechtenstein is higher with 78%. Switzerland’s prominence is somewhat surprising after the United States forced the country’s banks to fork over the names of American tax evaders. This was a sizeable crack in the country’s vaunted bank secrecy.

TJN describes the country’s current attitude as “white money for rich and powerful countries; black money for vulnerable and developing countries.” The Swiss bow to powerful nations like the United States but continue to offer the citizens of poorer nations the ability to evade taxes. This along with Switzerland’s “aggressive pursuit” of financial sector whistleblowers helped it earn its leading spot.

Today, Switzerland is lobbying the Trump administration to allow it to return to its old ways.

Luxembourg weighs in at number six. This founding member of the European Union has long acted as a brazen hub of legalized tax evasion. Since it mainly services corporate clients – and its former prime minister Jean-Claude Juncker is president of the European Commission – other EU countries have largely given it a pass despite its beggar-thy-neighbor economic strategy.

The TJN index and the Panama/Paradise Papers investigations reveal a secrecy world that acts like a living organism. It evolves and mutates to perpetuate its existence and evade controls. Also in the top ten are two locales – Singapore and Dubai – that are increasingly becoming the destination of choice for those who are spooked by tightening due diligence requirements elsewhere.

Singapore weighs in at number five:

An IMF report in 2014 estimated that “over 95 percent of all commercial banks in Singapore are affiliates of foreign banks: a testament to its extreme dependence on foreign – and offshore – money.” If you are curious where some of those Swiss accounts that were based in Geneva went, look to Singapore.

Dubai earns the ninth spot. According to TJN:

Dubai has an ask-no-questions, see-no-evil approach to commercial and financial regulation as well as foreign financial crimes. It has consequently attracted large financial flows and some of the world’s most high-profile criminals. A significant slice of the inbound money comes in the form of cash or gold.

The post New Financial Secrecy Index appeared first on Jake Bernstein.

Related posts:

Giant Leak of Offshore Financial Records Exposes Global Array of Crime and Corruption

Thanks for Secrecy World Reviews

EU Committee Report on Panama Papers

December 31, 2017

Happy New Year

Many years ago I lived in Central America . It was a time of civil war. People literally fought and died to win rights Americans took for granted. Fair elections. A functioning and impartial judicial system. Leaders that put the interests of their people above personal avarice. Freedom of expression without fear of government reprisal.

Today, as we bid farewell to an annus horribilis, I want to thank Donald Trump for reminding us of the value of those rights we have squandered for so many years. We neglectfully let them slip – long before Trump launched his campaign. Now, Trump’s assaults on the press, the justice system and our democratic norms have been so blatant, it is arousing the populace from its slumber.

One of the few bright spots of 2017 was the extraordinary level of civic engagement we witnessed. It began with the remarkable million-woman march on Washington. It has continued through sit-ins in the halls of Congress, mobilizations in special elections and an incredible outpouring of first-time candidates for political office. Americans have rediscovered that true democracy is more than a system of elections, it’s an ideal of civic participation.

Thank you, Donald, for the gift of revelation. May it spread far and wide.

Trump and his congressional majorities have shown all Americans – those who voted for them and those who did not – their true nature. Yes, some continue to discount what lies before their eyes. Yet every day the consequences become manifest and the blinders weigh more heavily. Actions speak louder than words.

The price of this gift is indeed dear. Anything of real value usually is. We can reckon the pain and suffering the rest of the year. Not today.

At the end of 2017, my thoughts go to Molly Ivins, my former boss and friend. Though she left us more than a decade ago, Molly has been on my mind often of late. We need her spirit more than ever.

For me, she gets the final word.

So keep fightin’ for freedom and justice, beloveds, but don’t you forget to have fun doin’ it. Lord, let your laughter ring forth. Be outrageous, ridicule the fraidy-cats, rejoice in all the oddities that freedom can produce. And when you get through kickin’ ass and celebratin’ the sheer joy of a good fight, be sure to tell those who come after how much fun it was.

The post Happy New Year appeared first on Jake Bernstein.

Related posts:

Trump Ocean Club Buyers

Turkey Offers Lesson in Media Intimidation

Trump’s First Appearance in the Panama Papers

December 8, 2017

Trump Ocean Club Buyers

The flurry of emails began in the spring of 2008. On one side was Marie Williams, representing the Trump Ocean Club International Sales Group. On the other was Mossack Fonseca, the law firm known as Mossfon, whose leaked data became the Panama Papers.

Construction on the 70-story tower in downtown Panama City was not yet complete at the time. Announced in April 2006, Trump Ocean Club International Hotel and Tower Panama would not launch until 2011, when the Trump family came down for a triumphant ribbon cutting alongside President Ricardo Martinelli and developer Roger Khafif.

Ivanka Trump was also there. When Trump first committed to the deal, he told Khafif he was sending Ivanka to Panama. The project would be her baby.

In 2007, Trump Ocean achieved a significant milestone. It pre-sold enough condos to convince Wall Street to back $220 million in construction financing. A significant portion of those early sales went to Russian buyers hiding behind anonymous shell companies. Few were seeking a home in which to live. Some were simply parking cash they had spirited out of Russia. Others, it now appears, were Russian mafia laundering money. They joined money launderers from South American drug cartels who were also buying property at Trump Ocean Club.

In September 2008, Donald Trump, Jr. said at a real estate conference that “Russians make up a pretty disproportionate cross-section of a lot of our assets… We see a lot of money pouring in from Russia.”

Fast forward to last week. The that condo owners in the Trump Ocean Club want to remove President Donald Trump’s name from the development. They also hope to fire his company’s management of the Ocean Club’s hotel.

Occupancy in the hotel has shriveled, according to reports. Condos aren’t selling either. Last August, 202 still-unsold condos were part of a sales package that included the Ocean Club’s restaurants and conference center. Khafif’s firm, Newland International Properties, filed for bankruptcy in 2013. Martinelli is living in Miami, fighting extradition back to Panama, where he faces criminal charges. The development shaped like a sail, or perhaps, as Ivanka Trump said, “a giant D,” is fast becoming an international symbol for money laundering.

How did it all go so wrong? The emails from the Panama Papers help tell the story.

Trump Ocean contacted Mossfon for translation services in June 2008. Khafif wanted the firm to translate the condo sales agreement from Spanish into Russian. It cost $15 a page. The total came to $600. The payment was late.

Trump’s own company was not directly involved in selling the units but it helped with the marketing. Trump reaped millions of dollars from the naming rights and management contract. Estimates are he took in well over $75 million from the development.

During those initial years, hot money was pouring into Panama. Some joked that those who complained about the traffic and parking from the new buildings filling the skyline had nothing to worry about – nobody actually lived in the apartments. The benign view was that these empty properties were awaiting Americans or Canadian snowbirds who would someday quit working and claim their retirement homes. Others suspected the bulk were being used for money laundering or as investments for wealthy elites from places like China and Russia. These buyers were unreliable. They would soon flip their properties, particularly at the first sign of trouble.

Trump and Khafif were not interested in asking too many questions about who purchased the Ocean Club units. They didn’t care that their building was built on a shaky foundation of flighty capital and money laundering. For Trump, it has always been about the quick score, consequences be damned. As long as he could maintain plausible deniability, the origins of the cash handed to him didn’t matter.

In one of her emails sent to Mossfon in 2008, Williams, the Trump sales executive, had another question:

Additionally, we are working with an Iranian broker who has individuals residing in Iran or who are residents in the UK with Iranian passports desiring to purchase in Panama. Does your firm have experience with Iranians? Would the visa requirements be any different from someone from Russia or Europe? You were so helpful with the information your forwarded before pertaining to Russians. I would like to create this same experience for this broker who has connections with the wealthy Iranian nationals.

On the campaign trail and as president, Trump savagely attacked Iran in speeches. He described the country as a “fanatical regime” that “raided the wealth of one of the world’s oldest and most vibrant nations, and spread death, destruction, and chaos all around the globe.”

Yet in private business, Trump grabbed that wealth with both hands.

The post Trump Ocean Club Buyers appeared first on Jake Bernstein.

Related posts:

Trump’s First Appearance in the Panama Papers

Panama Papers Update October 8, 2017

EU Committee Report on Panama Papers

December 6, 2017

Blacklisted Tax Havens

During the early 2000s, tax havens and the lawyers, accountants and bankers who serviced them fought a pitched battle with the Organisation for Economic Co-operation and Development (OECD). Revenue was vanishing into tax havens. The use of secret bank accounts and anonymous shell companies by Russian mobsters, drug cartels and kleptocratic politicians had become impossible to ignore. The secrecy world was lawless territory and international organizations like the OECD tried to impose some standards.

During the early 2000s, tax havens and the lawyers, accountants and bankers who serviced them fought a pitched battle with the Organisation for Economic Co-operation and Development (OECD). Revenue was vanishing into tax havens. The use of secret bank accounts and anonymous shell companies by Russian mobsters, drug cartels and kleptocratic politicians had become impossible to ignore. The secrecy world was lawless territory and international organizations like the OECD tried to impose some standards.

The stick the OECD wielded was the threat of a blacklist. If tax havens did not adopt reforms – information exchanges, better vetting of customers, more transparency, raising tax rates – the OECD threatened to restrict their access to the global financial system. This was a real threat. The OECD is truly an international organization. Its members include the United States and the other richest nations of the world.

However, the tax havens fought back. They had powerful ideological allies in Washington, including congressional Republicans and the Bush administration. Their efforts succeeded. More about this battle can be found in my book, Secrecy World. By March 2003, powerful offshore intermediaries like Panamanian law firm Mossack Fonseca declared victory.

“We are very pleased by the fact that the coordinated efforts of the offshore jurisdictions to repel harmful initiatives that once threatened the financial privacy of our customers have received proper recognition,” the firm told its clients in the company newsletter that year. “As a result we have before us a very positive outlook for the year 2003.”

The good times continue to this day. When the OECD first began its campaign it identified forty-seven tax havens worldwide. By June 2016, the OECD had a single country on its tax haven list, Trinidad & Tobago. Nobody on the planet – except the OECD – believed that Trinidad was a the sole tax haven, or even a significant one.

In April 2016, the Panama Papers were published worldwide to considerable attention. Gnashing of teeth and rending of garments ensued. Three months later, European Finance ministers launched a process to create a new blacklist. They worked through something called the Council’s Code of Conduct Group on Business taxation. The process was opaque and apparently marked by intense lobbying.

Yesterday, the EU process released the results to much fanfare. Seventeen jurisdictions were blacklisted: American Samoa, Bahrain, Barbados, Grenada, Guam, South Korea, Macau, Marshall Islands, Mongolia, Namibia, Palau, Panama, Saint Lucia, Samoa, Trinidad and Tobago, Tunisia and United Arab Emirates.

Another 47 jurisdictions were added to a grey list including Switzerland, Turkey and Hong Kong.

Given the fact that they were severely knocked about by a major hurricane in September, a number of the Caribbean tax havens such as the Bahamas, British Virgin Islands and the Turks and Caicos were given more time.

How the blacklist is to be implemented and what it really means, beyond bad press for those named, is a bit fuzzy. There are no economic sanctions attached to the list. It’s up to individual EU member states to take action.

Nonetheless, tax havens on the list protested fiercely. Panamanian President Juan Carlos Varela blasted his country’s inclusion as “unfair.” Panama, he asserted, is “not in any way a tax haven.”

The reactions from those who have campaigned for tax fairness and tax haven transparency ranged from scathing to dismissive.

Sven Giegold, a German Green EU parliament member who has spearheaded efforts against the tax havens had this to say:

From the very beginning EU Member States were entirely excluded from the screening process although the Netherlands, Ireland, Malta, Luxembourg, the UK and Cyprus do not comply with the EU’s own criteria. In the shadow of the opaque Code of Conduct Group, Member States successfully lobbied to get their own dependencies and overseas territories off the hook. If countries with a tax rate of zero do not appear on the blacklist, it is not worth the paper it is written on. Even worse, as long as the Council cannot agree on common and automatic sanctions against listed tax havens, the blacklist will be toothless.

British professor and accountant Richard Murphy, who has focused on this issue for decades, was skeptical but encouraged by one provision. The Council appears to have wheedled a commitment from the tax havens of Bermuda, Cayman Islands, Guernsey, Isle of Man and Jersey to address concerns about the use of their countries to attract profit that is earned elsewhere. These are major players in offshore corporate tax avoidance. We shall see if these commitments amount to anything meaningful.

The fact that the EU has ignored its own abusive states undermines much of the credibility that this list might have. That makes this a disappointment for all those who have campaigned for tax haven reform, even if the writing is on the wall for at least five British tax havens.

The new blacklist underscores the power of the press, and its limitations. The Panama Papers helped force this issue onto the agenda of European politicians who would be happier ignoring it. However, the major powers continue to exhibit a lack of will when it comes to reforming a system that bleeds countries of much-needed revenue and feeds global criminality.

The post Blacklisted Tax Havens appeared first on Jake Bernstein.

Related posts:

EU Committee Report on Panama Papers

Panama Papers Update

Trump’s First Appearance in the Panama Papers

November 28, 2017

Iceland Censors Glitnir Leak

Iceland has long boasted a progressive reputation. Outside the country, it’s seen as a beacon of freedom, tolerance and civic engagement. There is plenty of truth to this view.

Iceland has long boasted a progressive reputation. Outside the country, it’s seen as a beacon of freedom, tolerance and civic engagement. There is plenty of truth to this view.

Julian Assange helped craft Iceland’s media laws in 2010, and housed his organization’s payment system in Reykjavik. When the FBI arrived to investigate Wikileaks, Iceland’s interior minister ordered police not to cooperate.

After the 2008 financial crisis, Icelanders took to the streets in what became known as the pots and pans revolution. The government launched an investigation into the collapse of the country’s banks. It appointed a special prosecutor. More than twenty people including bankers were jailed for their actions. Granted prison in Iceland is cushy but the country did far more to prosecute financial crisis wrongdoing than the United States.

When Icelandic journalist Jóhannes Kr. Kristjánsson and a team from Swedish Public Broadcasting exposed Prime Minister Sigmundur Gunnlaugsson’s secret offshore company in the Panama Papers, Icelanders rallied once again. The people drove Gunnlaugsson from office.

However, recent events have tarnished Iceland’s image.

Last month, the Guardian, the Icelandic newspaper Stundin and Kristjánsson’s Reykjavik Media published an exposé based on leaked documents. Their story showed Prime Minister Bjarni Benediktsson, while a member of parliament in 2008, cashed out his assets in Glitnir bank right before the government took it over and imposed losses on those left behind. Benediktsson comes from a well-connected wealthy family in Iceland. He claims that he had no inside knowledge about the bank closure.

After the first story was published, the Reykjavik District Commission, at the request of the bankruptcy estate of Glitnir, put a gag order on Stundin and Reykjavik media prohibiting them from more news coverage based on the leak. Future stories were likely curtailed. In protest, Stundin published a front page that was blacked out. Icelandic journalism organizations protested. The gag remained nonetheless.

A court date for a judge to review the order is scheduled for January 6.

Still, the damage had been done. Benediktsson was up for election at the end of October. While it may not have changed the outcome, Icelandic voters were deprived of a full airing of information that could have informed their trip to the polls. Press freedom suffered a blow in an unlikely place. Benediktsson’s party won the largest share of seats.

In another surprise from the election, Gunnlaugsson came back from the dead. His new Centre Party received nearly 11 percent of the vote.

The post Iceland Censors Glitnir Leak appeared first on Jake Bernstein.

Related posts:

Giant Leak of Offshore Financial Records Exposes Global Array of Crime and Corruption

ICIJ Releases the Panama Papers Investigation

Turkey Offers Lesson in Media Intimidation

November 26, 2017

Foreign Agent Men

If former national security advisor Michael Flynn is indeed cooperating with special counsel Robert Mueller, the conversation with prosecutors likely includes information about clandestine lobbying for foreign powers by officials connected to Trump. This reflects a deeper corruption in Washington, D.C. beyond the self-interested actions of a single individual. Accepting foreign cash to influence U.S. policy has long besmirched both political parties. It is a recurring theme in Mueller’s Trump-Russia investigation.

If former national security advisor Michael Flynn is indeed cooperating with special counsel Robert Mueller, the conversation with prosecutors likely includes information about clandestine lobbying for foreign powers by officials connected to Trump. This reflects a deeper corruption in Washington, D.C. beyond the self-interested actions of a single individual. Accepting foreign cash to influence U.S. policy has long besmirched both political parties. It is a recurring theme in Mueller’s Trump-Russia investigation.

Last March, after Flynn was forced from his position in the White House, he publicly revealed Turkish interests had secretly paid him. Flynn’s company took $530,000 in August 2016 from a Turkish businessman in part to lobby the US government to extradite the cleric, Fethullah Gulen. Despite the payment, Flynn failed at that time to register as a foreign agent as required by law.

Turkish President Recep Tayyip Erdogan blames Gülen, who lives in Pennsylvania, for the attempted coup against him in the summer of 2016. Gülen’s followers have indeed been influential in Turkey’s government bureaucracy and throughout Turkish society. They represent a force in Turkey outside of Erdogan’s control. However, the Turkish government did not produce sufficient evidence of wrongdoing to convince the Obama administration to extradite Gülen to a country where the justice system is increasingly rigged to favor the executive branch and torture is common.

On the day Trump was elected president, the Hill published a hyperbolic op-ed by Flynn, who was at the time a Trump campaign surrogate secretly shilling for Turkey. Flynn compared Gülen to terrorists like Osama bin Laden and urged his extradition.

“The forces of radical Islam derive their ideology from radical clerics like Gülen, who is running a scam,” wrote Flynn. “We should not provide him safe haven. In this crisis, it is imperative that we remember who our real friends are.”

The Wall Street Journal has reported that the FBI is investigating whether Flynn was prepared to do much more than pen an opinion piece. He and his son, Michael Flynn Jr., allegedly participated in discussions about kidnapping Gülen and ferrying him via private jet to the Turkish prison island of Imrali. The Flynns allegedly offered to provide this service in return for $15 million.

Flynn was not the only influential member of the Washington establishment advocating for Gülen’s extradition. Former U.S. Ambassador to Turkey beginning in the Bush administration, James F. Jeffrey, also became a prominent voice promoting the Erdogan line. Jeffrey offered advice to the Trump transition team on Turkey from his perch at the nonprofit Washington Institute. He urged the new administration to extradite Gülen to reset relations with Turkey.

A confidential diplomatic cable leaked by Wikileaks from 2009 shows Jeffrey wrestling with the Gülen issue as ambassador. In the document, he details the history and scope of Gülen’s influence in Turkey. Jeffrey was clearly wary of Gülen but did not recommend the cleric’s deportation.

By August 2016, Jeffrey’s position had evolved. He is quoted in a Turkish newspaper exactly a month after the coup that “most indications, not just the Turkish government’s statements, point to the Gülenist movement,” as behind the uprising.

Just how far Jeffrey was willing to go to present the case can be seen in another Wikileaks release, this one from the private emails of Mehmet Ali Yalcindag, a wealthy Turkish business partner of Donald Trump. The two collaborated on the Trump Towers Istanbul. Yalcindag married into one of Turkey’s most prominent families, which controls media, real estate and oil interests through the Dogan Group. The family conglomerate has been under attack by Erdogan for its media coverage of the regime and over allegations of tax evasion.

Yalcindag, who is desperate to curry favor with Erdogan, forwarded an email with an opinion piece written by Jeffrey that was published in the German newspaper Die Zeit. The article forcefully called for the extradition of Gülen.

“Interesting insights about Gulen,” said the forwarded email. “The German public is slowly starting to understand the situation!”

Yalcindag sent the email to Serhat Albayrak, the brother of Erdogan’s son-in-law, Berat Albayrak, who is the Turkish minister of energy and is mentioned as a potential successor to Erdogan.

Six months later when U.S. Secretary of State Rex Tillerson traveled to Turkey, Jeffrey was quoted in a CBS News report accusing the Gülenists of being a threat to the US relationship with Turkey and the stability of the Middle East. Interestingly, Jeffrey had worked as an advisor to ExxonMobile when Tillerson was CEO of the oil company.

Reached by phone, Jeffrey said that he has not received money from the Turkish government or people acting on its behalf. He is not registered as a foreign agent nor does he have any plans to do so. Jeffrey denied having any contact with Michael Flynn. While he cannot provide proof of Gülen’s involvement in the coup attempt, Jeffrey holds fast to the desirability of extraditing the cleric.

Past efforts to influence U.S. policy by foreign governments and their proxies has shown that there are any number of ways to spread the money around to achieve the desired result. Case in point was the Azerbaijan America Alliance, for which former Indiana Republican Congressman Dan Burton, acted as the front man. The Alliance spent more than $12 million showering cash on politicians in Washington, lobbying for them to be friendly to Azerbaijan. It held gala dinners with attendees like Speaker of the House John Boehner and met privately with Senator John McCain and House minority leader Nancy Pelosi. With the avalanche of money came fulsome praise for the corrupt and autocratic regime from both Democrats and Republicans in Congress.

It is clear that the existing rules to bring some transparency to the policy-for-sale ethos in Washington has failed miserably.

The Foreign Agents Registration Act was first passed to flush out Nazi propaganda back in 1938. It requires agents representing the interests of foreign powers in a political or quasi-political capacity to disclose that relationship, including financial details. Potential penalties include fines and jail time. Unfortunately, the Justice Department sees it as voluntary and hasn’t bothered to enforce the law. Circa reported in March that the DOJ had only prosecuted four cases involving violation of the law in the past ten years.

Special counsel Mueller is signaling a break with tradition.

Unregistered lobbying was the lynchpin of Mueller’s indictment against Paul Manafort and Richard Gates. Mueller charged that Manafort and Gates had created a limited liability company to engage in lobbying, consulting and public relations for the Government of Ukraine. The alleged laundering of money by Manafort, some $18 million, was to hide the profits from his work as an unregistered foreign agent.

It’s worth quoting from the indictment at length on the matter:

It is illegal to act as an agent of a foreign principal engaged in certain United States influence activities without registering the affiliation. Specifically, a person who engages in lobbying or public relations work in the United States (hereafter collectively referred to as lobbying) for a foreign principal such as the Govennnent of Ukraine or the Party of Regions is required to provide a detailed written registration statement to the United States Department of Justice. The filing, made under oath, must disclose the name of the foreign principal, the financial payments to the lobbyist, and the measures undertaken for the foreign principal, among other information. A person required to make such a filing must further make in all lobbying material a “conspicuous statement” that the materials are distributed on behalf of the foreign principal, among other things. The filing thus permits public awareness and evaluation of the activities of a lobbyist who acts as an agent of a foreign power or foreign political party in the United States.

The post Foreign Agent Men appeared first on Jake Bernstein.

Related posts:

Turkey Offers Lesson in Media Intimidation

November 24, 2017

Trump’s First Appearance in the Panama Papers

The earliest appearance of Donald Trump in the Panama Papers shows how operating in the secrecy world is a game rich people play to hide their activities. For government officials, journalists and even ironically, the law firm behind the Panama Papers, determining who is behind a given shell company could be difficult. And as with many cases involving Mossack Fonseca companies, the files are incomplete.

The earliest appearance of Donald Trump in the Panama Papers shows how operating in the secrecy world is a game rich people play to hide their activities. For government officials, journalists and even ironically, the law firm behind the Panama Papers, determining who is behind a given shell company could be difficult. And as with many cases involving Mossack Fonseca companies, the files are incomplete.

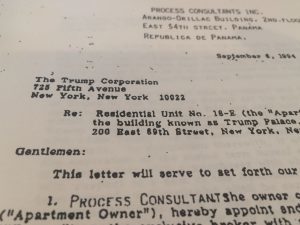

The story involves a Panamanian company called Process Consultans, Inc. No, that’s not a typo. There is no final “t” in Consultans. Except sometimes in the documents, including in letterhead, it is spelled with the “t.” Whether this was due to incompetence, necessity or purposeful muddying, the result is a company that is harder to track.

Process Consultans was owned through bearer shares. These share certificates were pieces of paper and whoever physically possessed them owned the company. For example, if Process bought an apartment in a Trump development, the company was the titleholder. Process itself was owned through two share certificates. If someone handed you those two pieces of paper, you would be the owner of the apartment. Bearer shares could be used to transfer assets completely anonymously. They were favorite tools of money launderers. For Mossack Fonseca, bearer shares were popular add-ons, a lucrative secrecy selling point.

The directors of Process Consultans were employees of Mossack Fonseca, including Jürgen Mossack himself. They acted as “nominee directors. These were fake directors, an extra service offered by the firm, which had the benefit of hiding who was really making decisions for the company. Nominee directors are a common ploy in the secrecy world.

Now, just because Process Consultans used bearer shares, nominee directors and had a fluid name doesn’t necessarily mean it was doing anything illegal. Figuring out who actually owned the company and where the money came from – and whether it was up to something improper – that’s where the fun usually began for journalists delving into the files.

There is nothing in the Panama Papers that explicitly states who is behind Process Consultans. The company was created in 1985 and back then Mossack Fonseca truly did not care who owned their companies, nor was there much legal obligation in Panama for them to do so. Instead the firm created a company – usually for a lawyer or a banker who solicited it on behalf of their client – stuffed the registration form in a file and forgot about it until a year passed and it was time to send an invoice for a renewal.

Nonetheless, it appears Process Consultans was originally created by Dresdner Bank LatinAmerika AG in Panama for a client. This person may have been a German-Ecuadorian industrialist, who found his way to the law firm through its Guayaquil franchisee. At some point, the law firm’s internal documents began to identify the company as originating in Luxembourg and connected to a branch of the Swiss bank UBS in Germany.

In 1991, Process Consultants, Inc. bought a unit in the newly constructed Trump Palace on 200 East 69 Street in Manhattan. The 54-story skyscraper was the tallest building above 60th Street.

“Trump Palace makes little effort to fit into its surroundings. It wants to stick out on the skyline like a prima donna… The truth is that Trump Palace is less an homage to the 20’s and 30’s than it is a hangover from the 80’s,” sniffed the New York Times.

The Trump Palace was open for business for foreign buyers and sellers, some of them hiding behind anonymous shell companies.

The person or persons behind Process Consultans decided to sell his condo in 1994. Trump Corporation was the exclusive broker. It was The Donald’s palace, after all. In September 1994, a document in the files details an agreement for the apartment, sale price $395,000. (Later, the price appears to have been whittled down to $355,000.)

The buyer of the apartment may have been from Hong Kong. There is a woman with the same name as the individual identified in the files as the person to whom the property was “transferred, ” that pops up in a previous offshore leak reported by ICIJ.

Unfortunately, the New York City Department of Finance online database ACRIS only has information on the apartment after 2005. At that point, it was owned by a Brazilian from Sao Paolo. He used his real name. That year he sold it for $795,400.

But the Process Consultans story does not end with the sale of the Trump apartment. In 2006, Mossack Fonseca contacted the Ecuadorian industrialist about his company. It appears the firm lost touch with the owner and believed he wanted the company dissolved. Mossack Fonseca went to UBS, which rejected any responsibility for the matter.

By 2008, Mossack Fonseca had created more than 160,000 offshore entities. This torrent of secret companies, particularly the older ones, had become difficult to manage. Still, as long as everyone got paid – including Donald Trump – nobody asked too many questions. Now, Mossack Fonseca wasn’t sure who to bill. It contacted the industrialist inquiring what was going on.

The Ecuadorian wrote back:

Gentlemen: I do no understand what you mean with this message. The company PROCESS CONSULTANTS INC. was established in Panama almost a cuarter of a century ago. Since then you send me the annual bills for the administration fees which I always paid to you. Why does the administrator (for me: YOU), suddenly come up with this strange comment? If there was any change concerning the registry or administration of PROCESSS CONSULTANTS INC. I would have been the first to know (and ACCEPT) it. Please enlighten me on the subject.

This blog post has been updated. I have replaced the word “first” with “earliest” in the first sentence to avoid any confusion. The Donald Trump organization appears elsewhere in the Panama Papers. Chronologically, this is the first instance of that I found.

The post Trump’s First Appearance in the Panama Papers appeared first on Jake Bernstein.

Related posts:

The Paradise Papers Hacking and the Consequences of Privacy

EU Committee Report on Panama Papers

Panama Papers Update

November 23, 2017

Thanks for Secrecy World Reviews

I’m feeling especially thankful today. And grateful, very grateful.

I’m feeling especially thankful today. And grateful, very grateful.

On Tuesday my book, Secrecy World, was published. We had a fantastic kickoff event at Barnes & Noble. Thank you to all who turned out.

As all books are, Secrecy World was a true labor of love. And, as with every book, the final product exists because of the support and insight of people other than the author. My list includes everyone from my superhumanly patient, brilliant wife Eve to sharp-eyed Holt editor Paul Golob to crackerjack reporter Ryan Chittum. The book also depended on the work of hundreds of kickass journalists around the world who form the International Consortium of Investigative Journalists. I am so thankful – as we all should be – that they labor on our behalf. Please see the acknowledgements in Secrecy World for a full list of all those who deserve thanks.

Now, the early reviews are beginning to arrive. And I am pleased for those who have read the book and found it meaningful, and even fun.

People like Joe Tauzer, who wrote on GoodReads:

This is book is great especially in the audio version! The reader is the author. This is not a liberal or conservative book, it’s an explanation of how what was learned in the Panama Papers. This book exposes how hiding money to avoid taxes is so universal among the world’s elite. How one companies hack has given the layman a window in to the creative and grotesque of accounting of the worlds rich.

https://www.icij.org

ICIJ is the organization we have to thank for compiling most of the data from the hacks. They have a great website which I recommend you look in to and try your alma mater in the search bar. I found my former college along with many of the colorful characters in this book, in the ranks entities who own offshore accounts.

David, also on GoodReads:

A lot of this very readable book is about the efforts of a large and far-flung team of investigative journalists who, often defying personal egomania, stifling bureaucracy, and the 24-hour-newscycle-driven desire for content now at any cost, worked effectively as a team and published simultaneously across the globe for maximum effect. There are many interesting (in an enraging kind of way) digressions in the story on the path to this end. For example: the 292-foot yacht Donald Trump bought in 1988 (l. 396) had a previous life as a floating brothel for a corrupt arms dealer, and former Vice-president Dick Cheney “was no stranger to offshore companies” (l. 1181), especially during certain Wyoming land deals in the 1990s.

David Wineberg, who wrote on Amazon:

Jake Bernstein has followed the leads backwards and forwards. He fills in the details of who the players are and how they got there. He also takes some minor side trips to corrupt practices like drug dealing, a slave ship, abandoned construction and a fraudulent reinsurer, to show how these players are actively ruining the lives of others with their fake firms. There is even a side trip to the Swiss tax-free art warehouses, where a good hundred billion dollars in precious art is hidden from view and taxation.

The book is structured like a tree. Each of the roots gets an airing, and they all lead up to the visible trunk – Mossack Fonseca, the Panamanian law firm from which all the documents were leaked. The roots consist of Mossfon bureaus around the world, dealing with various corrupt governments, corrupt banks and eager clients. The crown is the billowing scandals the journalists perpetrated, going off in many directions, covering the sky with corruption on a truly global scale.

Eileen Ruth, who wrote on Amazon:

This book reads like a suspense novel. If you want to learn how not to pay your taxes, this is a must read. It seems that the rich from all over the world are doing this. Whether it’s thru shell companies or art work.

Brenda Jubin, who wrote on her blog Reading the Markets, the book was “both riveting and dispiriting”:

Secrecy World is a must-read book for anyone with an interest in, and perhaps a sense of outrage over, how the rich protect their wealth. And, I should note, it’s not just through secret offshore accounts. Delaware and Nevada allow incorporations with virtually no due diligence.

Kirkus, which gave it a starred review:

Mossfon remains a maze worthy of a Cretan palace, but Bernstein does first-rate work in providing a map to a scandal that has yet to unfold completely.

Have a safe and happy Thanksgiving everyone!

Jake

The post Thanks for Secrecy World Reviews appeared first on Jake Bernstein.

Related posts:

Giant Leak of Offshore Financial Records Exposes Global Array of Crime and Corruption

Panama Papers Update October 8, 2017

Panama Papers: The Art of Secrecy

November 10, 2017

The Paradise Papers Hacking and the Consequences of Privacy

Last month, the international law firm Appleby announced it had been the victim of a hacking and that information on its clients was in the hands of the International Consortium of Investigative Journalists, the news gathering organization that broke the story of the Panama Papers in April 2016.

On Sunday, material from that hacking became public. The Paradise Papers exposed the hidden financial dealings of Commerce Secretary Wilbur Ross, Queen Elizabeth and the athletic apparel company Nike, among many others. As revelations about tax-dodging airplane purchases and secret Russian ownership in tech companies came to light, Appleby declared that it takes its clients’ confidentiality seriously and billed itself as “not the subject of a leak but of a serious criminal act.”

In an age in which personal consumer data is routinely plundered for profit, it’s smart public relations for law firms like Appleby and the tax havens in which their clients hide their assets to present themselves as victims of a global crime epidemic. There is also genuine belief operating here. Jürgen Mossack and Ramón Fonseca, the founders of the law firm whose hacked files formed the heart of the Panama Papers, described their work as safeguarding their clients’ fundamental right to privacy in their financial affairs. Mr. Mossack and Mr. Fonseca insisted that when their customers asked them to set up hundreds of thousands of anonymous companies, trusts and foundations, it too was in the interest of privacy.

However, in the world of offshore finance, privacy long ago became a corrosive secrecy.

Appleby is a major player in a global offshore industry that helps multinational corporations and the mega-wealthy legally move money beyond the reach of the taxman through a network of tax havens and secret financial centers. As a lawyer at Mossack Fonseca candidly wrote in a confidential internal memorandum, “95 percent of our work” is “selling vehicles to avoid paying taxes.”

The amounts involved are staggering. An estimated 8 percent of household financial wealth is held offshore, representing a loss in annual global tax revenue of about $190 billion. But this pales in comparison to the tax avoidance and tax evasion by the large multinational companies that use this system. All told, more than $7.6 trillion may well be hidden in tax havens around the world, according to Gabriel Zucman, an economist at the University of California, Berkeley, who studies the issue.

In Congress, Republicans promote lower tax rates for American corporations even as companies employ the offshore system to pay little tax on billions of dollars in profit. This uncomfortable reality is not the focus of the tax debate in part because firms like Appleby help keep these activities secret. The public is simply unaware.

Meanwhile, there is the torrent of illegal cash that washes through tax havens and secret bank accounts — cash that is often put to illicit use, from bribing public officials to arms trafficking. The research and advocacy organization Global Financial Integrity has estimated that transnational criminal activities account for $1.6 trillion to $2.2 trillion annually. And laundered money represents 2 percent to 5 percent of global G.D.P., according to a recent report by the European Parliament.

The right of privacy keeps this underground river of money secret, but its existence has real-world consequences. Tax avoidance robs governments of funds to pay for education, health care and infrastructure. Prices for homes in New York, Miami, Los Angeles, London and other cities have spiraled beyond the reach of most residents because the global elite, often hiding behind anonymous companies, parks cash in them. And the corruption it enables is a major factor in the persistence of dire poverty in resource-rich regions like Africa.

Last week, the special counsel Robert Mueller indicted Paul Manafort, the former chairman of Donald Trump’s presidential campaign, on money laundering charges. The indictment charges that Mr. Manafort used offshore Cypriot companies and overseas bank accounts to disguise payments from a foreign government and bring the money into the United States. Even after scrutiny by one of the most high-powered teams of prosecutors and investigators ever assembled, it’s still not clear how many millions of dollars passed through these various channels. “Manafort’s financial holdings are substantial, if difficult to quantify precisely because of his varying representations,” Mr. Mueller stated in one legal filing.

With the offshore world so expansive and so in need of transparency, it often falls to journalists and those with access to leaked data to shine light on these secret dealings. Privacy is not an absolute right when the public interest is at stake. And so, journalists must face a difficult question before seeking to publish information that comes from hackers or other unauthorized leaks: Does this information directly affect the well-being of society?

When it comes to the secrecy world, which caters to the moneyed elite and the politically powerful, the answer is often yes. Still, the Mossack Fonseca documents in the Panama Papers were full of confidential information about people who broke no laws. The exposure of this information did not meet a public interest test. Despite complaints by WikiLeaks and other advocacy groups that the International Consortium of Investigative Journalists should have posted all the Panama Papers material online, the organization never seriously contemplated such a move.

What it has done instead is create the world’s most extensive online database of offshore company names, directors and shareholders. This database is about to grow significantly thanks to the Paradise Papers revelations, which include information from 19 corporate registries held by tax havens. The consortium has created a resource that shines a light on shadowy activities that undermine the rule of law and the norms of public responsibility. In this way, a flag has been planted on the boundary between privacy and secrecy.

Op-ed published in the New York Times on Nov. 7, 2017

Jake Bernstein, a senior reporter for the International Consortium of Investigative Journalists in the Panama Papers investigation, is the author of “Secrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global Elite.”

#PanamaPapers #ParadisePapers #SecrecyWorld

The post The Paradise Papers Hacking and the Consequences of Privacy appeared first on Jake Bernstein.

Related posts:

Guide to the Paradise Papers

Panama Papers Update October 8, 2017

EU Committee Report on Panama Papers